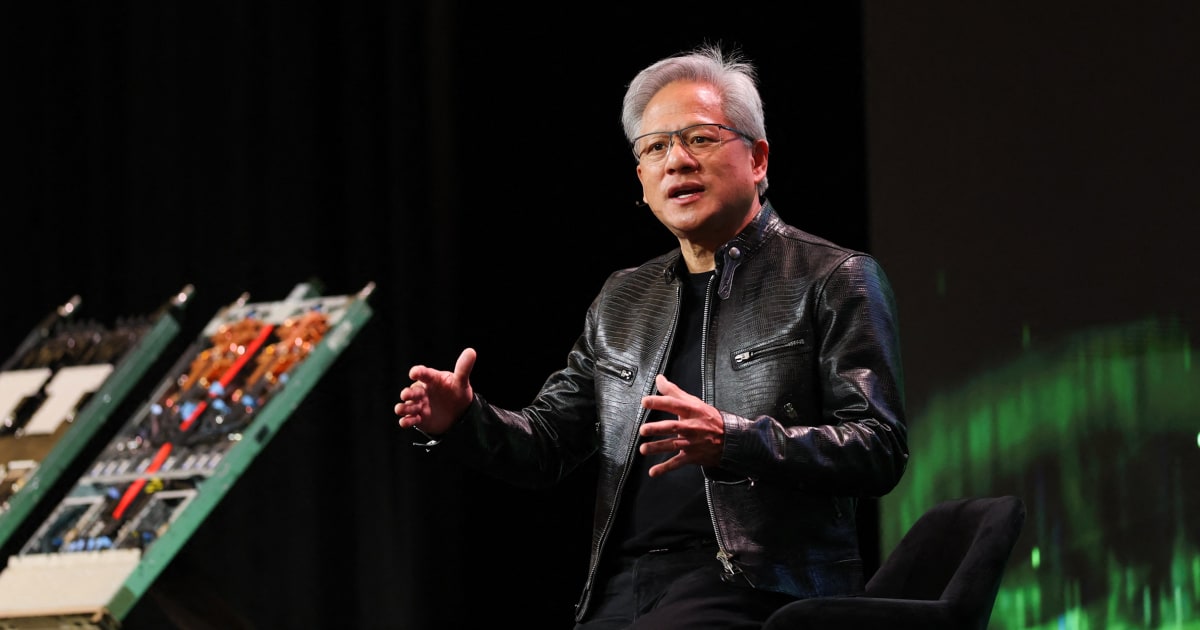

In a potential signal of shifting dynamics in the artificial intelligence sector, stocks of several companies specializing in data center cooling systems tumbled on Tuesday following Nvidia's announcement of more energy-efficient chips. Shares of Johnson Controls dropped 6.2 percent, Modine Manufacturing fell more than 7.4 percent, Trane Technologies declined 4 percent, and Carrier Global slipped nearly 1 percent. The declines came after Nvidia CEO Jensen Huang revealed details about the company's upcoming Vera Rubin chips during a keynote at the Consumer Electronics Show in Las Vegas.

Huang described the Vera Rubin chips as a significant advancement in AI hardware, emphasizing their efficiency in cooling requirements. 'The power of Vera Rubin is twice as high as Grace Blackwell,' Huang said, referring to Nvidia's current Blackwell generation of chips. He added, 'And yet, and this is the miracle, the air that goes into it — the airflow is about the same — and the water that goes into it ... is 45 degrees Celsius.' At that temperature, equivalent to 113 degrees Fahrenheit, Huang noted that 'no water chillers are necessary for data centers.' He further explained, 'We are basically cooling this supercomputer with hot water; it is so incredibly efficient.'

The announcement highlights how innovations in chip design could disrupt the infrastructure supporting the AI boom. Data centers, which house the powerful servers running AI models, have become sprawling complexes worldwide, with tech giants investing tens of billions of dollars in their construction and expansion. Companies like Johnson Controls, Modine, Trane, and Carrier provide the industrial cooling systems essential for maintaining optimal temperatures in these facilities, where high-powered chips generate immense heat.

Nvidia's chips have been at the forefront of the AI revolution, powering applications from chatbots to advanced computing tasks. The Vera Rubin generation, named after the astrophysicist Vera Rubin, is slated for availability to customers in the second half of 2026, according to Nvidia. This timeline suggests that while immediate impacts may be limited, longer-term shifts in data center designs could affect cooling equipment demand.

The AI investment surge has already strained resources, with data centers drawing scrutiny for their substantial water and electricity consumption. For instance, OpenAI, the maker of ChatGPT, has announced plans to build $1.4 trillion worth of computing capacity. Microsoft, a key partner to OpenAI, stated in October that it intends to increase its AI computing capacity by 80 percent over the coming year and roughly double its total data center footprint over the next two years.

Cooling systems are vital to these operations, as overheating can lead to costly disruptions. In November, a cooling failure at a data center used by the trading giant CME Group caused temperatures to rise, resulting in a 10-hour shutdown of systems that process trillions of dollars in commodities and futures trades for investors from London to Hong Kong. The incident underscored the reliance on chillers to keep equipment operational.

Analysts reacted swiftly to Huang's comments, viewing them as a possible concern for the cooling industry. 'We believe the comments create some questions/concerns,' wrote analysts at the investment firm Baird in a note to clients on Tuesday. They added, 'We don’t see a big risk to near-term estimates, but expect news to create some incremental concerns around orders, especially later in 2026.'

Baird highlighted the recent growth in data centers as a boon for heating, ventilation, and air conditioning (HVAC) companies. 'Unsurprisingly, data centers have been a substantial area of growth for HVAC companies,' the analysts noted. They pointed out that cooling providers have benefited from strong demand over the past 12 to 18 months, driven not only by the expansion of data centers but also by increasing cooling density requirements for more powerful equipment.

Not all experts share the same level of apprehension. Citigroup industrials analyst Andrew Kaplowitz downplayed the immediate threat in a message to clients, stating, 'While we understand investor concern around the end market dynamics, we view the HVAC sell-off activity ... as overdone.' Kaplowitz emphasized that the architecture of the Rubin chips 'still requires liquid cooling capabilities,' suggesting that some form of advanced cooling will remain necessary.

Market reactions were mixed beyond the cooling specialists. Shares of Vertiv Holdings, a data center infrastructure provider, closed slightly higher on Tuesday after an earlier drop of more than 7 percent. Despite the day's losses, Johnson Controls has still risen more than 45 percent over the past year, reflecting the broader tailwinds from AI-driven demand.

The episode illustrates the interconnected nature of the AI ecosystem, where breakthroughs in one area can ripple through supply chains. Nvidia's push toward more efficient chips aligns with industry efforts to address sustainability concerns. Data centers currently consume vast amounts of energy—equivalent to the output of several power plants—and their water usage for cooling has sparked debates in regions facing shortages. For example, facilities in arid areas like the southwestern United States have faced local opposition over groundwater depletion.

Huang's presentation at CES, held from January 7 to 10 in Las Vegas, drew attention not just for the technical details but for their implications on the trillion-dollar AI race. Nvidia, valued at over $3 trillion as of recent trading, has seen its stock soar amid the AI hype, but Tuesday's news tempered enthusiasm in adjacent sectors.

Looking ahead, the Vera Rubin chips could influence how tech companies plan their infrastructure. Microsoft's aggressive expansion plans, for instance, involve partnerships with utilities to secure power and cooling solutions. If Nvidia's efficiency claims hold, future data centers might require less intensive chilling, potentially lowering operational costs but challenging equipment suppliers to innovate.

Industry observers will watch closely as more details emerge about the Rubin platform. Baird's analysts suggested that while short-term orders may remain robust, the 2026 rollout could prompt reevaluation of long-term projections. Citigroup's perspective offers a counterbalance, indicating that the market's reaction might be an overcorrection in a still-growing sector.

As the AI boom continues to reshape economies and technologies, events like Nvidia's CES reveal underscore the rapid evolution of supporting industries. For cooling companies, adapting to these changes will be key to sustaining their role in the digital infrastructure buildout.